Comprehensive Amex Personal Loans Review: Everything You Need to Know About American Express Personal Loans

#### Amex Personal Loans ReviewWhen considering personal loans, American Express (Amex) offers a range of options that can cater to various financial needs……

#### Amex Personal Loans Review

When considering personal loans, American Express (Amex) offers a range of options that can cater to various financial needs. This detailed **Amex Personal Loans Review** will explore the features, benefits, and potential drawbacks of choosing Amex for your borrowing needs.

#### Overview of Amex Personal Loans

American Express is well-known for its credit cards and financial services, but it also provides personal loans to eligible cardholders. These loans are typically unsecured, meaning you don’t need to provide collateral to secure the loan. This feature makes Amex personal loans an attractive option for those looking to consolidate debt, finance a large purchase, or cover unexpected expenses.

#### Key Features of Amex Personal Loans

1. **Loan Amounts**: Amex personal loans generally range from $3,500 to $40,000, allowing borrowers to select a sum that meets their specific needs.

2. **Flexible Terms**: Borrowers can choose loan terms that typically range from 12 to 36 months, giving them the flexibility to manage repayment according to their financial situation.

3. **Fixed Interest Rates**: One of the standout features of Amex personal loans is the fixed interest rates. This means that your monthly payments will remain the same throughout the life of the loan, making it easier to budget.

4. **No Origination Fees**: Unlike many other lenders, Amex does not charge origination fees, which can save borrowers money upfront.

5. **Fast Funding**: Once approved, funds can be disbursed quickly, often within a day, allowing for timely access to cash when it’s needed most.

#### Benefits of Choosing Amex Personal Loans

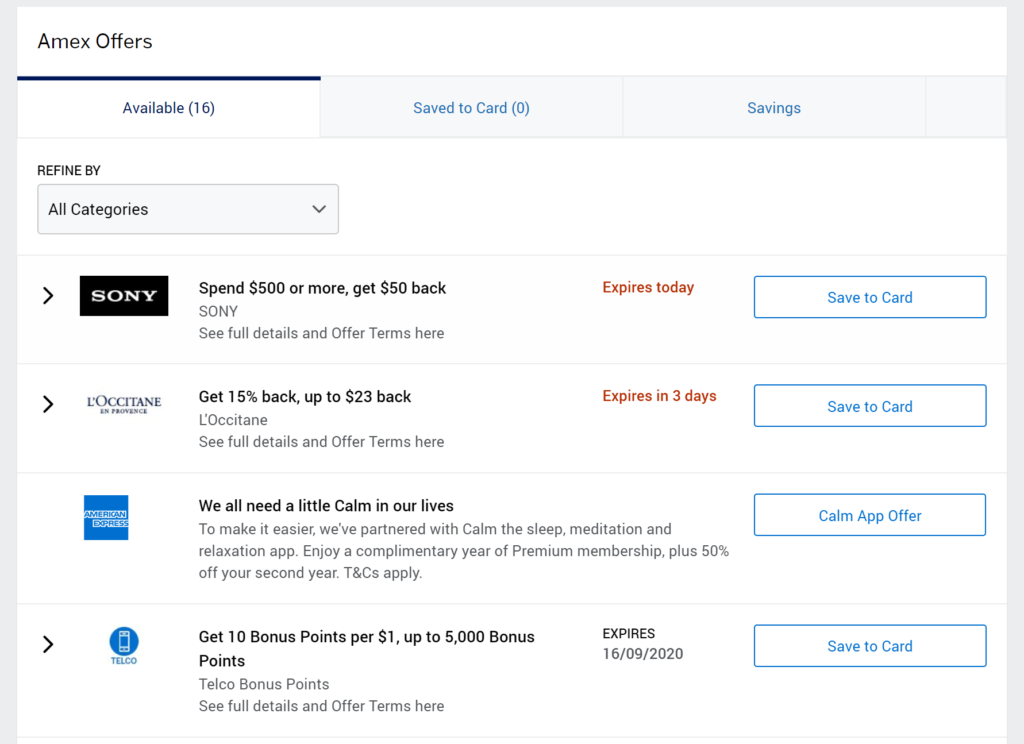

- **Loyalty Benefits**: Existing American Express cardholders may find additional benefits or promotional offers, making the application process smoother and potentially more rewarding.

- **Customer Service**: Amex is known for its excellent customer service, which can be a significant advantage when navigating the loan process.

- **Online Management**: Borrowers can easily manage their loans online through the American Express website or mobile app, providing convenience and accessibility.

#### Potential Drawbacks

While there are many advantages to Amex personal loans, it’s essential to consider potential drawbacks:

- **Eligibility Requirements**: Only American Express cardholders can apply for these personal loans, which may limit access for some borrowers.

- **Credit Score Requirements**: Amex typically requires a good to excellent credit score for approval, which can be a barrier for those with lower credit ratings.

- **Higher Interest Rates**: Depending on your creditworthiness, the interest rates may be higher compared to other lenders, which could increase the overall cost of borrowing.

#### Conclusion

In summary, the **Amex Personal Loans Review** highlights a competitive offering for eligible American Express cardholders seeking personal loans. With flexible terms, no origination fees, and the backing of a reputable financial institution, these loans can be an excellent choice for those who qualify. However, it’s crucial to weigh the benefits against the eligibility requirements and potential costs. Always consider your financial situation and compare different loan options before making a decision.