### How Do I Record a Loan in QuickBooks: A Step-by-Step Guide for Small Business Owners

When it comes to managing finances, small business owners often face the challenge of accurately recording loans in their accounting software. If you're ask……

When it comes to managing finances, small business owners often face the challenge of accurately recording loans in their accounting software. If you're asking, **how do I record a loan in QuickBooks**, you're not alone. This comprehensive guide will walk you through the process, ensuring that your financial records are accurate and up to date.

#### Understanding the Importance of Recording Loans

Before delving into the steps, it’s essential to understand why recording a loan is crucial for your business. Loans represent a liability on your balance sheet, and failing to record them can lead to inaccurate financial statements. This, in turn, can affect your business decisions, tax filings, and even your ability to secure future financing.

#### Step-by-Step Process to Record a Loan in QuickBooks

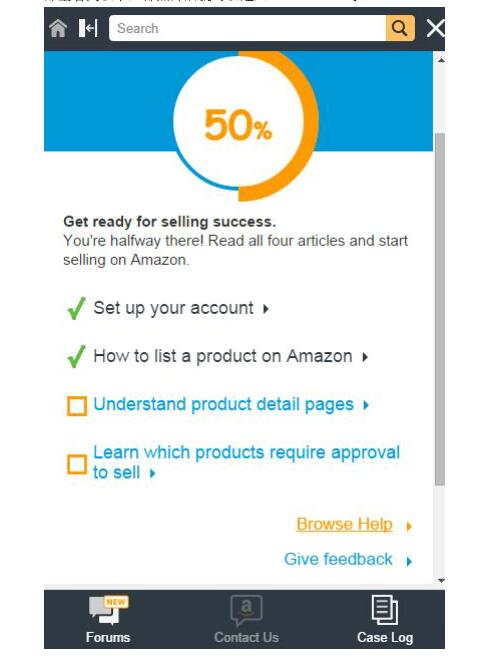

1. **Set Up a Loan Account**

To start, you need to create a liability account specifically for the loan. Here’s how:

- Go to the **Chart of Accounts**.

- Click on **New**.

- Choose **Liability** as the account type.

- Select **Long Term Liability** or **Current Liability**, depending on the loan's duration.

- Name the account (e.g., "Bank Loan") and fill in other necessary details.

2. **Record the Loan Amount**

After setting up the account, you need to record the loan amount. Follow these steps:

- Navigate to the **Banking** menu and select **Make Deposits**.

- In the deposit window, choose the loan account you just created.

- Enter the loan amount as a deposit.

- Save the transaction.

3. **Record Monthly Payments**

As you start making payments on the loan, you need to record them correctly:

- Go to the **Banking** menu and select **Write Checks** or **Pay Bills**.

- Choose the loan account as the expense account.

- Enter the payment amount, date, and any other relevant details.

4. **Track Interest Payments**

If your loan includes interest, it's important to track these payments separately:

- Create an expense account for interest payments.

- Record interest payments in the same way you record loan payments, ensuring you categorize them under the interest expense account.

5. **Review Your Financial Statements**

Regularly review your financial statements to ensure that the loan and interest payments are accurately reflected. This will help you maintain a clear picture of your business's financial health.

#### Common Mistakes to Avoid

When recording loans in QuickBooks, small business owners often make several common mistakes:

- **Failing to Record Interest Payments:** Always track interest separately to avoid confusion in your financial records.

- **Misclassifying Loan Accounts:** Ensure that you classify your loan as a liability to maintain accurate financial statements.

- **Neglecting to Reconcile Accounts:** Regularly reconcile your loan account with your bank statements to catch any discrepancies early.

#### Conclusion

In conclusion, understanding **how do I record a loan in QuickBooks** is essential for small business owners looking to maintain accurate financial records. By following the steps outlined in this guide, you can ensure that your loans are recorded correctly, helping you make informed financial decisions. Always remember to review your accounts regularly and seek professional advice if needed. With the right practices in place, managing loans in QuickBooks can be a straightforward process, allowing you to focus on growing your business.