Understanding Your Auto Car Loan Payment: Tips for Managing Payments and Finding the Best Deals

When it comes to purchasing a vehicle, one of the most significant financial decisions you'll make is how to manage your auto car loan payment. This payment……

When it comes to purchasing a vehicle, one of the most significant financial decisions you'll make is how to manage your auto car loan payment. This payment is not just a monthly expense; it’s a commitment that can impact your financial health for years to come. Understanding how to navigate this process is crucial for any car buyer.

#### What is an Auto Car Loan Payment?

An auto car loan payment is the amount you pay each month to repay a loan taken out to purchase a vehicle. This payment typically includes the principal amount borrowed, the interest charged by the lender, and sometimes additional fees or insurance costs. The total amount of your monthly payment will depend on several factors, including the loan amount, the interest rate, the loan term, and your credit score.

#### Factors Affecting Your Auto Car Loan Payment

1. **Loan Amount**: The more you borrow, the higher your monthly payment will be. It’s essential to assess how much you can afford to spend on a vehicle and stick to that budget.

2. **Interest Rate**: Your interest rate is determined by your credit score and the lender's policies. A lower interest rate will result in a lower auto car loan payment. It’s wise to shop around for the best rates before committing to a loan.

3. **Loan Term**: The length of your loan affects your monthly payment. Shorter loan terms typically have higher monthly payments but lower total interest costs. Conversely, longer terms may offer lower monthly payments but can lead to paying more in interest over time.

4. **Down Payment**: A larger down payment reduces the amount you need to borrow, which can lower your monthly payment. If possible, aim to make a substantial down payment to ease the burden of your auto car loan payment.

#### Tips for Managing Your Auto Car Loan Payment

- **Create a Budget**: Before taking out a loan, create a budget that includes your auto car loan payment alongside other expenses. This will help you understand what you can afford without stretching your finances too thin.

- **Consider Refinancing**: If interest rates drop or your credit score improves, consider refinancing your loan. This can lead to lower monthly payments and save you money in interest over the life of the loan.

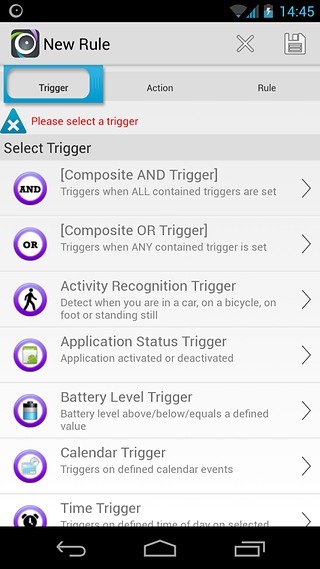

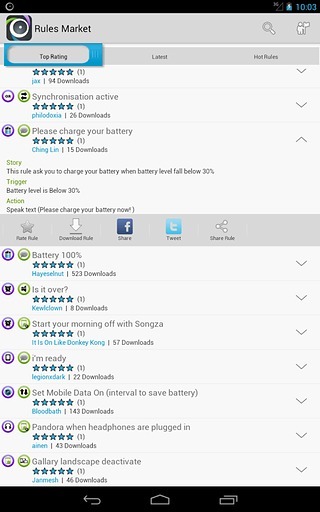

- **Set Up Automatic Payments**: To avoid late fees and potential damage to your credit score, consider setting up automatic payments for your auto car loan payment. This ensures that your payment is made on time every month.

- **Communicate with Your Lender**: If you find yourself struggling to make your payments, reach out to your lender. They may offer options such as deferment or loan modification to help you through tough times.

#### Finding the Best Deals for Your Auto Car Loan Payment

To secure the best possible auto car loan payment, it’s essential to shop around. Here are some strategies:

- **Research Lenders**: Look beyond traditional banks. Credit unions and online lenders often offer competitive rates.

- **Check Your Credit Score**: Before applying for a loan, check your credit report and score. Addressing any discrepancies can improve your chances of securing a better interest rate.

- **Get Pre-Approved**: Obtaining pre-approval from a lender can give you a better idea of what you can afford and streamline the car-buying process.

- **Negotiate**: Don’t be afraid to negotiate the terms of your loan. Lenders may be willing to offer better rates or terms if you ask.

In conclusion, understanding and managing your auto car loan payment is vital for a successful car-buying experience. By being informed and proactive, you can make decisions that will benefit your financial future.