Maximize Your Car Loan Potential: A Comprehensive Guide to Leveraging Loan Calculators for Cars

Guide or Summary:Understanding Loan Calculators for CarsMaximizing Your Car Loan PotentialThe world of automotive finance is a labyrinth of options, terms……

Guide or Summary:

The world of automotive finance is a labyrinth of options, terms, and conditions that can be daunting for even the most savvy car shoppers. Amidst this maze, loan calculators for cars emerge as invaluable tools designed to simplify the process of securing a car loan. These digital assistants provide a structured approach to understanding the intricacies of car loans, helping consumers make informed decisions that align with their financial goals and needs.

In this comprehensive guide, we delve into the world of loan calculators for cars, offering insights into how these tools can be harnessed to maximize your car loan potential. We explore the various features and benefits of using these calculators, emphasizing their role in the loan application process and the pivotal role they play in financial planning for car purchases.

Understanding Loan Calculators for Cars

At its core, a car loan calculator is a financial tool that assists consumers in estimating the total cost of a car loan, including interest rates, monthly payments, and the total amount paid over the loan term. These calculators are designed to be user-friendly, allowing consumers to input specific details such as the loan amount, interest rate, and loan term, and receive instantaneous results.

The primary advantage of using a loan calculator for cars is its ability to provide a clear and concise overview of the financial implications of a car loan. This information is crucial for making informed decisions, as it helps consumers understand the true cost of owning a car, including the total interest paid over the life of the loan. By providing this transparency, loan calculators empower consumers to compare different loan options, making it easier to find the most suitable loan for their financial situation.

Maximizing Your Car Loan Potential

To maximize your car loan potential, it's essential to leverage the features and functionalities of loan calculators for cars. Here are some strategies for doing so:

1. **Customization and Personalization**: Loan calculators often offer customization options, allowing users to input specific details such as the down payment, insurance costs, and maintenance expenses. By personalizing these details, consumers can get a more accurate estimate of the total cost of ownership, helping them make more informed financial decisions.

2. **Exploring Different Loan Terms**: Loan calculators enable consumers to explore various loan terms, including different interest rates and repayment periods. This feature is particularly useful for consumers looking to optimize their financial situation, as it allows them to compare the total cost of different loan options and choose the one that best fits their budget and financial goals.

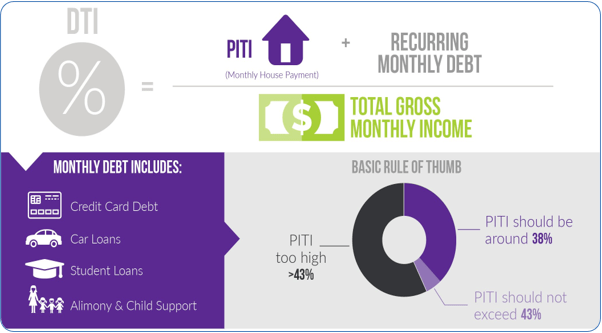

3. **Assessing Affordability**: Perhaps one of the most critical features of a loan calculator for cars is its ability to assess affordability. By inputting specific details such as monthly income and existing debts, consumers can determine whether a particular car loan is financially feasible. This assessment is essential for preventing financial strain and ensuring that car ownership remains a sustainable and enjoyable aspect of life.

4. **Identifying Hidden Costs**: Loan calculators can also help identify hidden costs associated with car ownership, such as registration fees, taxes, and maintenance expenses. By factoring these costs into the calculation, consumers can get a more comprehensive understanding of the total cost of ownership, enabling them to make more informed decisions.

In conclusion, loan calculators for cars are indispensable tools for anyone looking to secure a car loan. By providing transparency, customization options, and the ability to explore different loan terms, these calculators empower consumers to make informed financial decisions. Whether you're a first-time car buyer or looking to upgrade your current vehicle, leveraging loan calculators for cars can help you maximize your car loan potential, ensuring a smooth and financially responsible car ownership experience.