Unlock Quick Financial Solutions with Express Loans Online

## Description:In today's fast-paced world, financial emergencies can arise unexpectedly, leaving many individuals scrambling for quick solutions. Whether i……

## Description:

In today's fast-paced world, financial emergencies can arise unexpectedly, leaving many individuals scrambling for quick solutions. Whether it's an unexpected medical bill, urgent home repairs, or an unplanned expense, having immediate access to funds can make a significant difference. This is where express loans online come into play, offering a convenient and efficient way to secure the money you need without the lengthy processes associated with traditional lending methods.

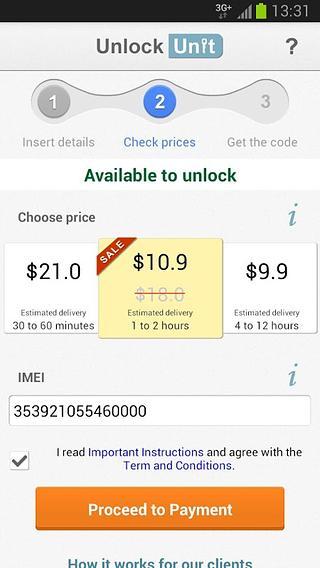

Express loans online are designed to provide quick access to funds, often within a matter of hours. Unlike conventional loans that may require extensive paperwork, lengthy approval processes, and collateral, express loans online streamline the borrowing experience. With just a few clicks, you can complete an application from the comfort of your home or on the go, making it an ideal solution for those who need cash in a hurry.

### Benefits of Express Loans Online

One of the primary advantages of express loans online is the speed at which you can obtain funds. Many lenders offer same-day approval and disbursement, allowing you to tackle your financial challenges without delay. This is especially beneficial for individuals who may not have the luxury of time when facing urgent expenses.

Additionally, the application process for express loans online is typically straightforward. Most lenders require minimal documentation, often just proof of income and identification, making it accessible for a wide range of borrowers. This simplicity is a significant draw for those who may feel overwhelmed by the complexities of traditional lending.

Moreover, express loans online can also cater to individuals with varying credit histories. While traditional banks may impose strict credit score requirements, many online lenders are more flexible, considering factors beyond just credit scores. This inclusivity opens the door for those who may have faced financial difficulties in the past but are now seeking to improve their financial situation.

### Understanding the Costs

While express loans online offer quick access to funds, it's essential to understand the costs associated with them. Interest rates can vary significantly between lenders, and while some may offer competitive rates, others might charge higher fees. It's crucial to conduct thorough research and compare different lenders to find the most favorable terms.

Many online lenders provide transparent information about their fees and interest rates, which can help you make informed decisions. Be sure to read the fine print and understand the total cost of borrowing, including any potential penalties for late payments or early repayment.

### Responsible Borrowing

When considering express loans online, it's vital to approach borrowing responsibly. While the convenience of quick cash can be tempting, it's essential to assess your ability to repay the loan. Create a budget that accounts for monthly payments and ensure that taking on additional debt will not strain your finances further.

If you find yourself in a cycle of borrowing, it may be worth exploring alternatives or seeking financial advice. Many organizations provide resources to help individuals manage their finances better and avoid the pitfalls of excessive debt.

### Conclusion

In conclusion, express loans online provide a practical solution for those in need of quick financial assistance. With their fast application processes, minimal documentation requirements, and accessibility for various credit profiles, they are an attractive option for many borrowers. However, it's crucial to approach these loans with caution, ensuring that you fully understand the costs and are prepared to manage the repayment effectively.

By doing your homework and selecting a reputable lender, you can leverage express loans online to navigate financial challenges and pave the way toward greater financial stability. Whether you're facing an unexpected expense or simply need a boost to get through the month, these loans can offer the relief you need when time is of the essence.