Max Personal Loan Requirements

Guide or Summary:What Are TitleMax Personal Loan Requirements?Additional Considerations for TitleMax Personal Loan RequirementsWhy Choose TitleMax for Your……

Guide or Summary:

- What Are TitleMax Personal Loan Requirements?

- Additional Considerations for TitleMax Personal Loan Requirements

- Why Choose TitleMax for Your Personal Loan?

When it comes to securing a personal loan, understanding the specific requirements is crucial for a smooth application process. TitleMax, a leading provider of personal loans, offers an accessible option for those in need of quick cash. This article will delve into the TitleMax personal loan requirements, ensuring you are well-prepared to take the next step towards financial freedom.

What Are TitleMax Personal Loan Requirements?

To qualify for a TitleMax personal loan, there are several key requirements that applicants must meet. First and foremost, you need to be at least 18 years old and a resident of the state where you are applying. This age requirement ensures that you have the legal capacity to enter into a loan agreement.

Another critical aspect of the TitleMax personal loan requirements is the need for a valid government-issued ID. This could be a driver’s license, state ID, or passport. The purpose of this requirement is to verify your identity and ensure that you are who you claim to be.

Additionally, TitleMax requires proof of income. This can be in the form of recent pay stubs, bank statements, or tax returns. Demonstrating a steady income stream is vital, as it assures the lender that you have the means to repay the loan. If you are self-employed, you might need to provide additional documentation to verify your income.

Additional Considerations for TitleMax Personal Loan Requirements

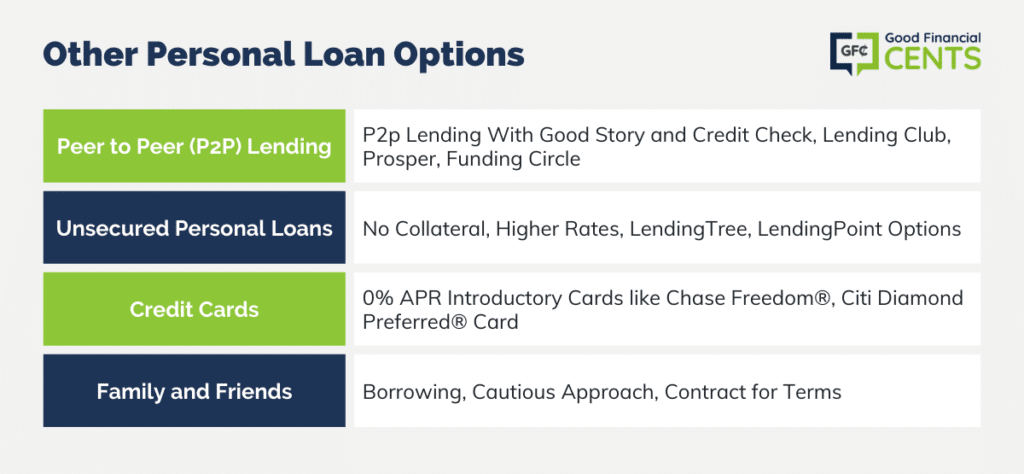

While the basic requirements are straightforward, there are a few additional considerations to keep in mind. TitleMax may also evaluate your credit history as part of the application process. Although they are known for providing loans to individuals with less-than-perfect credit, having a better credit score can enhance your chances of securing a larger loan amount or more favorable terms.

Collateral is another factor to consider. TitleMax primarily offers title loans, which means you will need to provide the title of your vehicle as collateral. This requirement can be beneficial, as it allows you to borrow a larger sum of money compared to unsecured loans. However, it’s crucial to understand that if you fail to repay the loan, you risk losing your vehicle.

Why Choose TitleMax for Your Personal Loan?

Choosing TitleMax for your personal loan needs comes with several advantages. Their streamlined application process is designed to be user-friendly, allowing you to apply online or in-person at one of their many locations. This flexibility makes it easier to get the funds you need quickly, often within the same day.

Moreover, TitleMax prides itself on customer service. Their knowledgeable staff can guide you through the application process, answering any questions you may have along the way. This level of support can make a significant difference, especially for first-time borrowers.

In conclusion, understanding the TitleMax personal loan requirements is essential for anyone considering a personal loan. By ensuring that you meet the necessary criteria, you can increase your chances of approval and secure the funds you need to achieve your financial goals. Whether you’re facing an unexpected expense or looking to consolidate debt, TitleMax offers a viable solution for your personal loan needs. Don’t hesitate to take that first step towards financial freedom today!