"Understanding FHA Loan PMI Removal: Your Guide to Eliminating Mortgage Insurance Premiums"

#### What is FHA Loan PMI?FHA loans, or Federal Housing Administration loans, are popular among first-time homebuyers due to their lower down payment requir……

#### What is FHA Loan PMI?

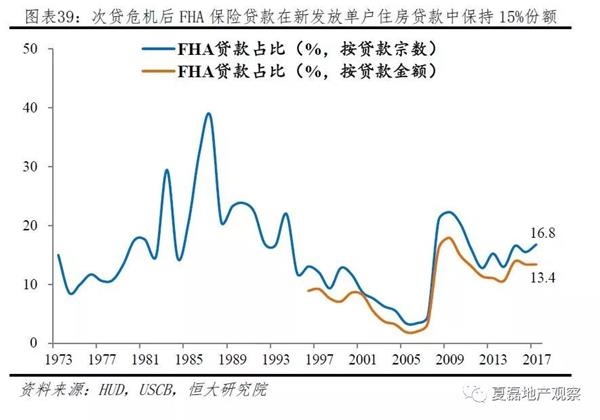

FHA loans, or Federal Housing Administration loans, are popular among first-time homebuyers due to their lower down payment requirements. However, one significant drawback is the mortgage insurance premium (PMI) that borrowers must pay. PMI protects lenders in case the borrower defaults on the loan, but it can add a substantial amount to monthly payments. Understanding FHA Loan PMI removal is crucial for homeowners looking to reduce their financial burden.

#### When Can You Remove FHA Loan PMI?

FHA Loan PMI is typically required for the life of the loan if you put down less than 10%. However, if you made a down payment of 10% or more, you can request PMI cancellation after 11 years. For those who put down less than 10%, the PMI will remain for the duration of the loan unless you refinance into a conventional loan or reach 20% equity through appreciation or additional payments.

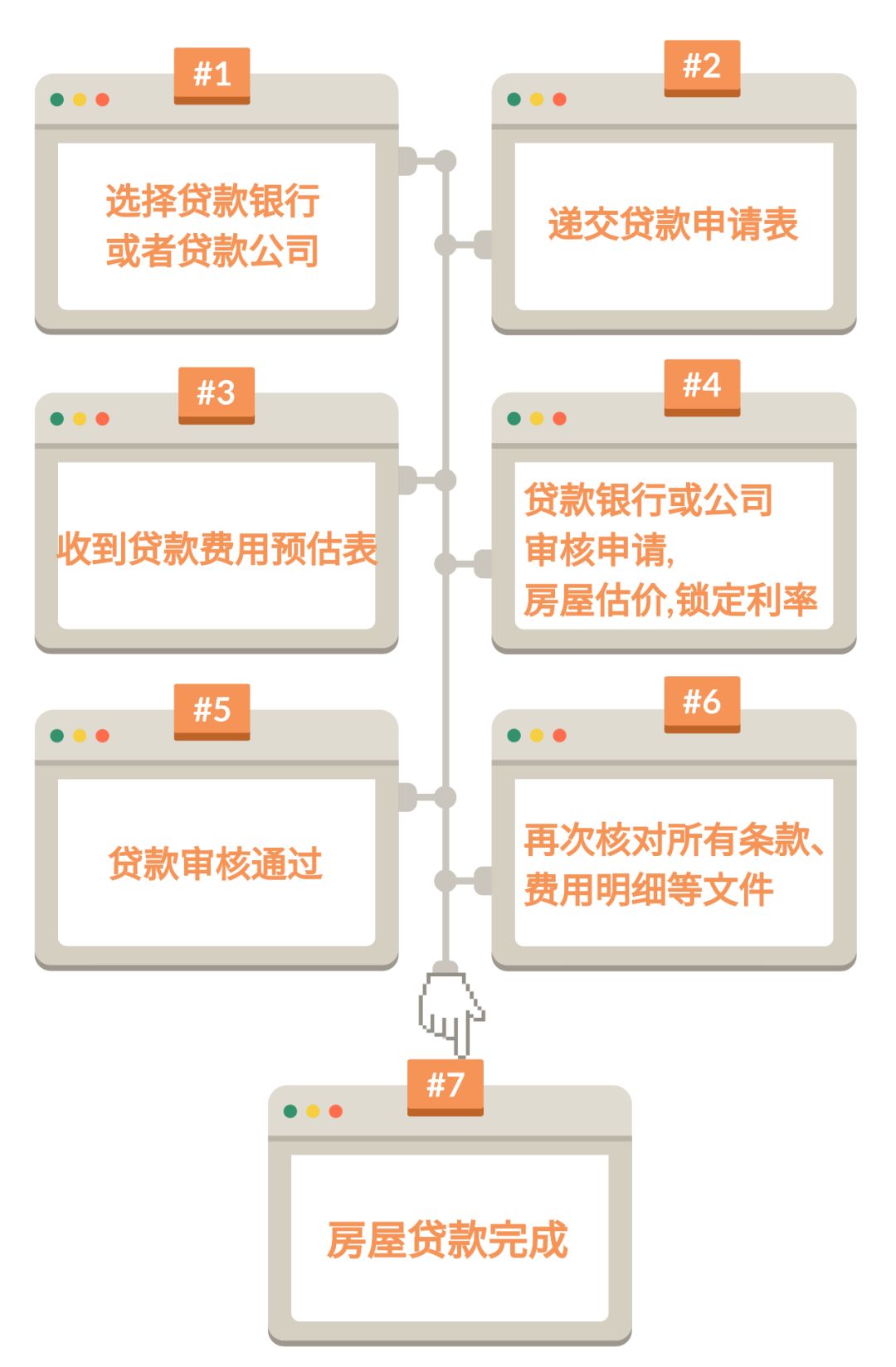

#### Steps to Remove FHA Loan PMI

1. **Monitor Your Home’s Value**: Keep an eye on the real estate market to see if your home has appreciated in value. You may be closer to that 20% equity mark than you think.

2. **Request a Home Appraisal**: If you believe your home has increased in value, you can request a new appraisal to determine its current market value. This can help establish your equity percentage.

3. **Contact Your Lender**: Once you have the necessary information, contact your lender to discuss your options for removing PMI. They will guide you through their specific process for PMI cancellation.

4. **Consider Refinancing**: If you are unable to remove PMI through your current FHA loan, consider refinancing into a conventional loan. This can eliminate PMI altogether, provided you have at least 20% equity in your home.

#### Benefits of FHA Loan PMI Removal

Removing FHA Loan PMI can lead to significant savings on your monthly mortgage payments. This reduction can free up funds for other expenses or investments. Additionally, without PMI, you can build equity in your home faster, allowing you to pay off your mortgage sooner or invest in home improvements.

#### Conclusion

FHA Loan PMI removal is an important consideration for homeowners looking to save money and build equity. By understanding the requirements and steps involved, you can take action to eliminate this extra cost. Whether through appreciation, refinancing, or other means, taking control of your mortgage insurance can lead to a more financially secure future. If you're uncertain about the process, consider consulting with a mortgage professional who can provide personalized advice and guidance tailored to your specific situation.