### Family Loan Agreement Template Free: A Comprehensive Guide

#### Introduction to Family Loan AgreementsIn today's world, borrowing money from family members has become a common practice. However, to avoid misundersta……

#### Introduction to Family Loan Agreements

In today's world, borrowing money from family members has become a common practice. However, to avoid misunderstandings and maintain healthy relationships, it's essential to have a written agreement in place. A **family loan agreement template free** can serve as a valuable tool for both lenders and borrowers. This article will provide an in-depth look at what a family loan agreement is, why it's important, and how to create one using a free template.

#### What is a Family Loan Agreement?

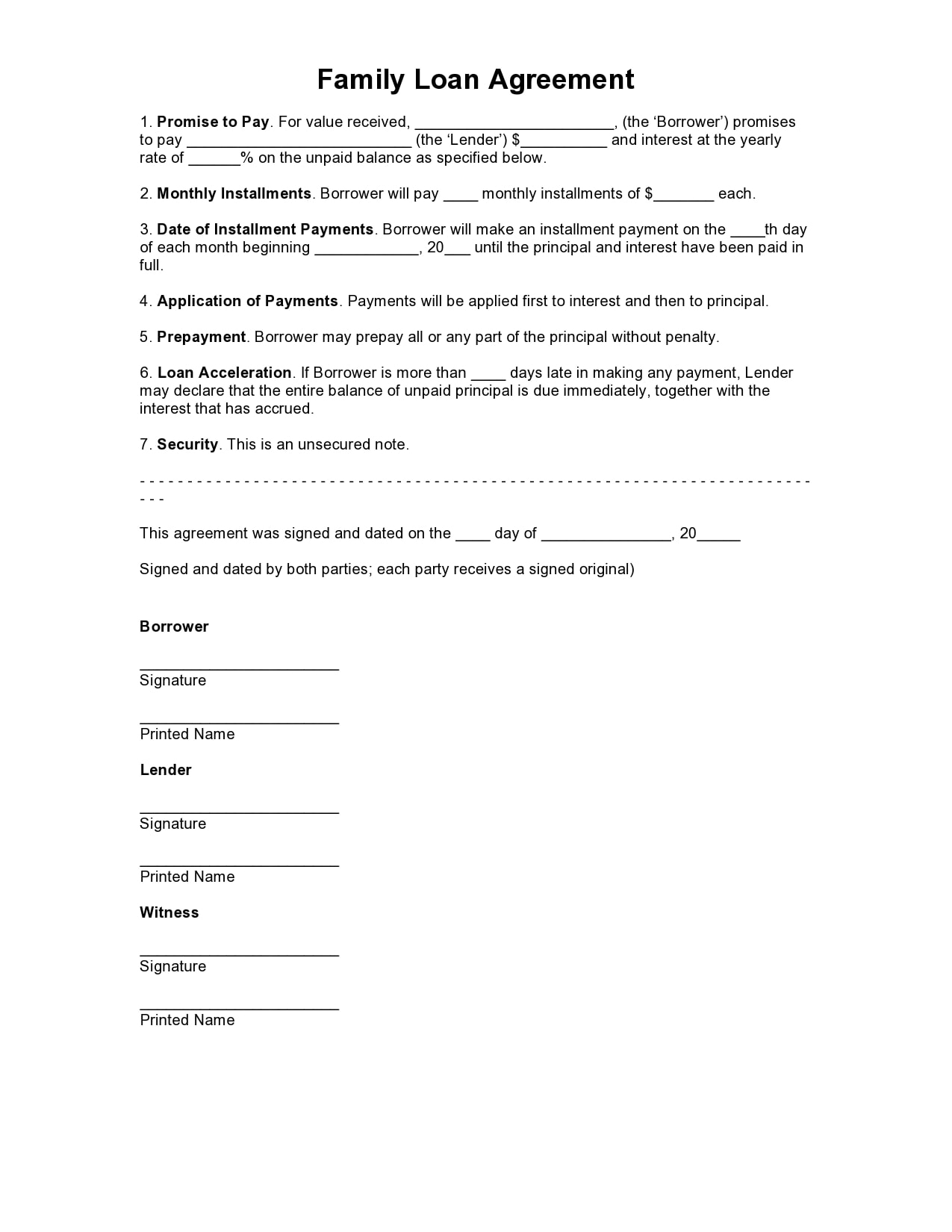

A family loan agreement is a legal document that outlines the terms and conditions of a loan made between family members. It specifies the amount of money being borrowed, the interest rate (if any), the repayment schedule, and other important details. Using a **family loan agreement template free** can help ensure that all parties are on the same page and can prevent potential disputes in the future.

#### Why Use a Family Loan Agreement?

1. **Clarity**: A written agreement provides clarity on the terms of the loan. This can help prevent misunderstandings that could lead to conflict.

2. **Legal Protection**: While family loans may seem informal, having a written agreement can provide legal protection for both parties. In the event of a dispute, the agreement can serve as evidence in court.

3. **Financial Responsibility**: A loan agreement encourages borrowers to take the loan seriously and adhere to the repayment schedule, fostering a sense of responsibility.

4. **Tax Implications**: Depending on the amount of money involved, there may be tax implications for both the lender and the borrower. A formal agreement can help clarify these issues.

#### Components of a Family Loan Agreement

When creating a family loan agreement, it's important to include the following components:

- **Loan Amount**: Clearly state the amount of money being borrowed.

- **Interest Rate**: Specify whether the loan will have an interest rate and, if so, what it will be.

- **Repayment Schedule**: Outline how and when the borrower will repay the loan. This could be in monthly installments or a lump sum.

- **Default Terms**: Include what will happen if the borrower fails to repay the loan as agreed.

- **Signatures**: Both parties should sign the agreement to make it legally binding.

#### How to Create a Family Loan Agreement Using a Free Template

1. **Find a Template**: Start by searching for a **family loan agreement template free** online. There are many resources available that offer customizable templates.

2. **Customize the Template**: Fill in the necessary details, such as the names of the parties involved, the loan amount, interest rate, and repayment terms.

3. **Review the Agreement**: Both parties should carefully review the agreement to ensure that all terms are clear and acceptable.

4. **Sign the Agreement**: Once both parties are satisfied, sign the agreement to make it official.

5. **Keep a Copy**: Both the lender and the borrower should keep a signed copy of the agreement for their records.

#### Conclusion

A **family loan agreement template free** is an invaluable resource for anyone considering borrowing or lending money within the family. By creating a formal agreement, you can protect your relationship and ensure that both parties understand their obligations. With the right template and a clear understanding of the terms, you can navigate family loans with confidence and transparency. Whether you're lending money for a major purchase or borrowing to cover unexpected expenses, having a written agreement can make all the difference.