Understanding the Benefits and Trends of 15 Year Loan Mortgage Rates

#### 15 Year Loan Mortgage RatesWhen considering a mortgage, many borrowers come across the term "15 year loan mortgage rates." This type of mortgage is str……

#### 15 Year Loan Mortgage Rates

When considering a mortgage, many borrowers come across the term "15 year loan mortgage rates." This type of mortgage is structured to be paid off over a period of 15 years, as opposed to the more common 30-year mortgage. The appeal of a 15-year loan lies in its typically lower interest rates and the ability to build equity in a home more quickly.

#### Advantages of 15 Year Loan Mortgage Rates

One of the primary advantages of opting for a 15-year mortgage is the lower interest rate compared to a 30-year mortgage. Lenders often offer better rates for shorter loan terms because the risk of default is lower. Over the life of the loan, this can save homeowners a significant amount in interest payments. For instance, if you take out a $300,000 mortgage at a 3% interest rate for 15 years, you would pay approximately $232,000 in interest over the life of the loan. In contrast, a 30-year mortgage at a higher interest rate could lead to over $300,000 in interest payments.

#### Building Equity Faster

Another compelling reason to consider 15 year loan mortgage rates is the speed at which you build equity in your home. Since you're paying off the principal more quickly, you own a larger portion of your home earlier in the loan term. This can be particularly beneficial if you plan to sell your home in the future or if you want to tap into your home equity for other financial needs, such as home improvements or education expenses.

#### Monthly Payments

While the benefits of lower interest rates and faster equity building are appealing, it's essential to consider the monthly payment implications of a 15-year mortgage. The monthly payments will be higher than those of a 30-year mortgage because you're paying off the loan in half the time. For many borrowers, this can strain their monthly budget. It's crucial to evaluate your financial situation and ensure that you can comfortably manage the higher payments without sacrificing other essential expenses.

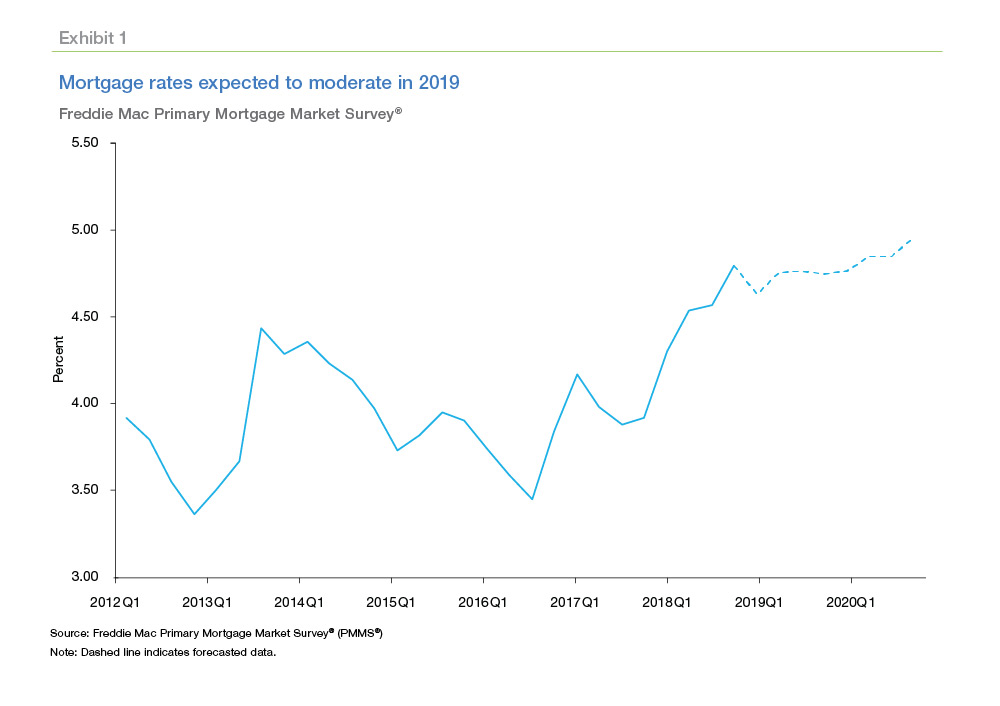

#### Current Trends in 15 Year Loan Mortgage Rates

As of late 2023, the housing market has seen fluctuations in mortgage rates due to various economic factors, including inflation and Federal Reserve policies. Homebuyers are increasingly looking at 15-year loans as a way to secure lower rates amid rising costs. It's advisable to stay informed about current trends and consult with a mortgage professional to understand how these rates can impact your home buying process.

#### Conclusion

In conclusion, 15 year loan mortgage rates present a compelling option for many homebuyers. With lower interest rates and the ability to build equity quickly, they offer significant financial advantages. However, potential borrowers must carefully consider their financial situation and the implications of higher monthly payments. By staying informed about current trends and working with a knowledgeable mortgage professional, you can make an informed decision that aligns with your long-term financial goals.