How to Secure an Auto Loan to Buy from a Private Seller: A Comprehensive Guide

#### Understanding Auto LoansAn auto loan to buy from private seller is a financial product that allows you to borrow money specifically for purchasing a ve……

#### Understanding Auto Loans

An auto loan to buy from private seller is a financial product that allows you to borrow money specifically for purchasing a vehicle from an individual rather than a dealership. This type of loan can be an excellent option for those looking to save money or find unique vehicles that may not be available through traditional dealerships. However, navigating the process can be a bit complex, especially if you're unfamiliar with private sales and financing.

#### Benefits of Buying from a Private Seller

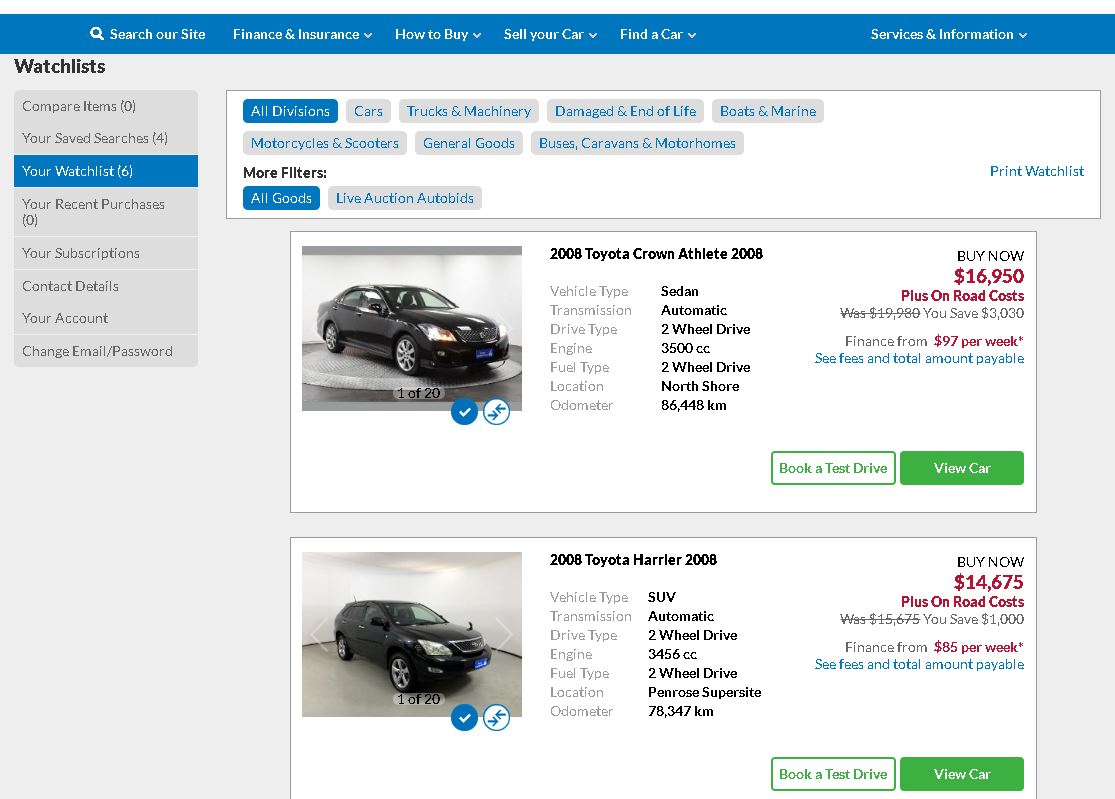

One of the primary advantages of purchasing a vehicle from a private seller is the potential for cost savings. Private sellers often have lower overhead costs than dealerships and may be willing to negotiate on price. Additionally, buying from a private seller can provide access to a wider range of vehicles, including rare or classic models.

#### Challenges of Securing an Auto Loan for Private Sales

While there are numerous benefits, there are also challenges associated with obtaining an auto loan to buy from private seller. Many traditional lenders prefer financing vehicles purchased from dealerships due to the perceived lower risk. This can make it more challenging to secure a loan for a private sale. Additionally, private sales often lack the structured environment of dealerships, which can complicate the loan process.

#### Steps to Secure an Auto Loan for a Private Purchase

1. **Research Lenders**: Start by researching lenders that specialize in auto loans to buy from private seller. Some credit unions and online lenders are more flexible with private sales than traditional banks.

2. **Check Your Credit Score**: Your credit score plays a significant role in determining your loan eligibility and interest rates. Obtain a copy of your credit report and ensure there are no errors that could negatively impact your score.

3. **Determine Your Budget**: Before approaching a seller or lender, determine how much you can afford to borrow and repay. Consider the total cost of ownership, including insurance, maintenance, and fuel.

4. **Get Pre-Approved**: Once you have identified potential lenders, seek pre-approval for your loan. This will give you a better idea of how much you can borrow and strengthen your negotiating position with the seller.

5. **Negotiate with the Seller**: With your pre-approval in hand, you can negotiate confidently with the private seller. Be prepared to discuss the vehicle's condition, history, and any necessary repairs.

6. **Complete the Sale**: Once you and the seller have agreed on a price, finalize the sale. Ensure that all necessary paperwork is completed, including the bill of sale, title transfer, and any loan documentation.

#### Final Considerations

In conclusion, obtaining an auto loan to buy from private seller can be a rewarding experience if approached correctly. By conducting thorough research, understanding the benefits and challenges, and following the necessary steps, you can successfully navigate the process of purchasing a vehicle from a private seller. Remember to take your time, ask questions, and ensure that you are making a well-informed decision. With the right preparation, you can find the perfect vehicle while securing favorable financing options.