Discover How to Use the Auto Loan Calculator at Bank of America for Your Next Vehicle Purchase

#### Understanding the Auto Loan Calculator Bank of AmericaThe **auto loan calculator Bank of America** is a powerful tool that assists potential car buyers……

#### Understanding the Auto Loan Calculator Bank of America

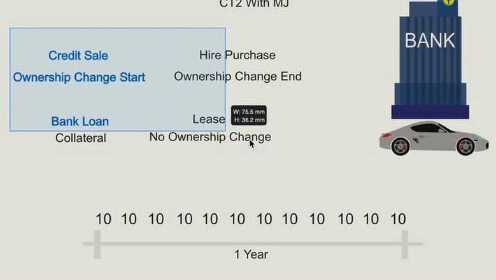

The **auto loan calculator Bank of America** is a powerful tool that assists potential car buyers in estimating their monthly payments, total loan costs, and interest rates. This online calculator simplifies the auto financing process, allowing users to input various parameters such as loan amount, interest rate, and loan term to see how these factors influence their financial commitments.

#### Why Use the Auto Loan Calculator?

Using the **auto loan calculator Bank of America** can provide you with a clearer picture of your financial situation before you make a purchase. It helps you determine how much you can afford to borrow and guides you in making informed decisions about your loan options. By inputting different scenarios, you can see how changes in loan amounts or interest rates affect your monthly payments, enabling you to adjust your budget accordingly.

#### How to Access the Auto Loan Calculator

Accessing the **auto loan calculator Bank of America** is straightforward. Simply visit the Bank of America website and navigate to their auto loans section. Here, you will find the calculator prominently displayed. You can start by entering the price of the vehicle you wish to purchase, the amount you plan to put down as a down payment, the interest rate you expect to receive, and the length of the loan term.

#### Key Features of the Calculator

The **auto loan calculator Bank of America** offers several features that enhance your experience:

1. **Adjustable Parameters**: You can easily modify the loan amount, interest rate, and loan term to see how each change impacts your monthly payment and total interest paid over the life of the loan.

2. **Amortization Schedule**: Some calculators provide an amortization schedule, allowing you to see how much of each payment goes toward the principal and how much goes toward interest.

3. **Comparison Tool**: You can compare different loan scenarios side by side, helping you to choose the best option for your financial situation.

4. **User-Friendly Interface**: The calculator is designed to be intuitive, making it easy for anyone to use, even those who may not be financially savvy.

#### Benefits of Using the Bank of America Auto Loan Calculator

1. **Financial Clarity**: By using the **auto loan calculator Bank of America**, you gain a better understanding of your financial obligations, which can alleviate stress when making a significant purchase.

2. **Budgeting Assistance**: The calculator allows you to set a budget for your car purchase and stick to it, preventing overspending.

3. **Pre-Approval Insights**: Knowing your potential monthly payments can help you get pre-approved for a loan, making the buying process smoother and more efficient.

4. **Time Savings**: Instead of visiting multiple dealerships to gather financing information, you can quickly estimate your costs from the comfort of your home.

#### Conclusion

In conclusion, the **auto loan calculator Bank of America** is an invaluable resource for anyone looking to finance a vehicle. It empowers users with the knowledge they need to make informed decisions about their auto loans. By understanding how to use this tool effectively, you can navigate the complexities of auto financing with confidence, ensuring that you choose a loan that fits your budget and financial goals. Whether you're a first-time buyer or looking to upgrade your current vehicle, leveraging the power of the auto loan calculator can significantly enhance your purchasing experience.